Car Rental Guide

Luxurious San Francisco Townhouse for Rent - Your Dream Urban Residence

Thursday, August 31, 2023

Thursday, August 31, 2023

San Francisco is one of the most expensive cities in the world to rent a townhouse. In this article, we will explore the average rent prices for townhouses in San Francisco, as well as factors that can affect rent prices. We will also provide tips for finding a townhouse rental in San Francisco.

- San Francisco Townhouse Rent

- Townhomes For Rent San Francisco

- San Francisco Corporate Apartments

- San Francisco Corporate Apartments

- Furnished Rentals San Francisco

- Serviced Apartments In San Francisco

- Serviced Apartments In San Francisco

- Furnished Apartments For Rent San Francisco

- Apartment Short Term Rental San Francisco

- Short Term Lease Apartments San Francisco

- San Francisco High Rise Apartments For Rent

- Apartments In Soma

- San Francisco Apartments Near Sfsu

- Fillmore Center Apartments San Franc

Convenient and Affordable San Francisco Car Rental Services

Thursday, August 31, 2023

Thursday, August 31, 2023

Planning a trip to San Francisco? Renting a car is a great way to explore the city and surrounding area. In this guide, we'll cover everything you need to know about car rental in San Francisco, from finding the best deals to getting around the city.

- San Francisco Car Rental

- Car Rental Geary Street San Francisco

- Car Rental Nob Hill San Francisco

- Enterprise Rent A Car Union Square San Francisco

- Car Rental Near Fisherman's Wharf

- San Francisco Sfo Car Rental

- Car Rental Near San Francisco

- Car Rental San Francisco Fisherman's Wharf

- Car Rental Under 21 San Francisco

- Avis Rental San Francisco

- Expedia Car Rental San Francisco Airport

- 15 Seater Van Rental San Francisco

- Luxury Yacht Rental San Francisco

- Fashion Furniture Los Angeles

Video Equipment Rentals Los Angeles: Where to Find the Best Gear for Your Production

Thursday, August 3, 2023

Thursday, August 3, 2023

Are you looking for video equipment rentals in Los Angeles? Whether you're a professional filmmaker or just starting out, there are a number of great options available to you. In this article, we'll take a look at some of the best places

- Video Equipment Rentals Los Angeles

- Rent Camera Equipment Los Angeles

- Camera Gear Rental Los Angeles

- Video Camera Rental Los Angeles

- Video Lighting Rental Los Angelescamera Rentals Los Angeles

- Lens Rentals Los Angeles

- Lighting Rentals Los Angeles

- Sound Equipment Rentals Los Angeles

- Video Production Los Angeles

Apartments for Rent in San Diego: A Guide to Finding the Perfect Place

Wednesday, August 2, 2023

Wednesday, August 2, 2023

San Diego is a beautiful city with a lot to offer, and finding the perfect apartment to rent can be a daunting task. This guide will help you narrow down your search and find the perfect place for you.

- Apartments For Rent San Diego

- San Diego Apartments

- San Diego Apartment Hunting

- San Diego Apartment Rentals

- San Diego Apartment Prices

- San Diego Apartment Amenities

- San Diego Pet-friendly Apartments

- San Diego Parking-included Apartments

- San Diego Apartments

- Rooms For Rent San Diego

- Studio Apartments San Diego

- La Jolla Apartments

- Mission Valley Apartments

- Studios For Rent San Diego

- Craigslist San Diego Apartments

- Zillow Rentals San Diego

Short Term Rentals in San Jose: Ideal Options for Vacationers and Business Travelers

Monday, July 31, 2023

Monday, July 31, 2023

San Jose is a vibrant city with a lot to offer visitors, from world-class museums to stunning scenery. Whether you're planning a vacation or a business trip, short term rentals are a great way to experience the best of San Jose.

- Short Term Rentals In San Jose

- Short Term Apartments San Jose

- Furnished Short Term Rentals San Jose

- Short Term Rentals San Jose Ca

- Short Term Lease Apartments San Jose

- Short Term Housing San Jose

- San Jose Furnished Apartments Short Term

- Short Term Apartment Rentals San Jose

- Short Term Lease San Jose

- Short Term Furnished Apartments San Jose Ca

- San Jose Temporary Housing

- Corporate Housing San Jose Ca

- Short Term House Rentals San Jose

How to Handle a Car Accident in California?

Thursday, July 27, 2023

Thursday, July 27, 2023

Getting into a car accident can be a stressful and confusing experience. If you're ever involved in a car accident in California, it's important to know what to do. This guide will walk you through the steps you need to take to handle a car accident

Slip and Fall Lawyer Los Angeles Get the Compensation You Deserve

Thursday, July 27, 2023

Thursday, July 27, 2023

If you have been injured in a slip and fall accident in Los Angeles, you may be entitled to compensation for your medical bills, lost wages, and pain and suffering. A slip and fall lawyer in Los Angeles can help you file a claim and get the money you

- Slip And Fall Lawyer Los Angeles

- Slip And Fall Attorney Los Angeles

- Premises Liability Attorney Los Angeles

- Los Angeles Slip And Fall Lawyer

- Slip And Fall Lawyer Laslip And Fall Lawyer Los Angeles

- Slip And Fall Accident

- Personal Injury Lawyer

- Property Owner Liability

- Compensation For Slip And Fall Injuries

Accident Lawyers in Los Angeles CA: Find the Best Representation for Your Case

Thursday, July 27, 2023

Thursday, July 27, 2023

If you've been injured in a car accident in Los Angeles, you need to speak with an experienced accident lawyer as soon as possible. A good lawyer can help you get the compensation you deserve for your medical bills, lost wages, and pain and suffering

- Accident Lawyers In Los Angeles Ca

- Accident Lawyer Lancaster Ca

- Accident Lawyer San Bernardino

- Bicycle Accident Attorney In Los Angeles

- Slip And Fall Lawyer Los Angeles

- Best Accident Attorney Los Angeles

- Best Accident Lawyers In Los Angeles

- Accident Lawyer Los Angeles

- Accident Attorney Los Angeles

- Bicycle Accident Lawyer Los Angeles

- Best Car Accident Lawyer Los Angeles

- Best Accident Lawyer Los Angeles

- Motorcycle Accident Lawyer Los Angeles

Cheap Car Rentals in Los Angeles: How to Save Money on Your Next Rental

Thursday, July 27, 2023

Thursday, July 27, 2023

Los Angeles is a sprawling city with a lot to see and do, but it can be difficult to get around without a car. If you're looking for cheap car rentals in Los Angeles, there are a few things you can do to save money.

- Cheap Car Rentals Los Angeles

- Best Car Rental Los Angeles Airport

- Cheap Car Rental Los Angeles International Airport

- Cheap Car Hire Los Angeles

- Cheapest Way To Rent A Car In Los Angeles

- Cheap Car Rental Los Angeles Airport

- Cheap Car Rental La

- Kayak Car Rental Los Angeles

- Best Car Rental Los Angeles

- Super Cheap Car Rental Los Angeles

- Car Rental Deals Los Angeles

- Best Car Rental Deals Los Angeles

- Cheap Exotic Car Rental Los Angeles

- Cheap Car Hire La

Cheap Car Rentals in California: Find the Best Deals on Rental Cars

Thursday, July 27, 2023

Thursday, July 27, 2023

California is a beautiful state with so much to see and do, but it can be expensive to get around. If you're looking for a way to save money on your trip, consider renting a car. There are a number of budget-friendly car rental companies

- Cheap Car Rentals California

- Car Rental Sacramento Airport

- Car Rental Oakland Airport

- Car Rental Burbank Airport

- Car Rental San Jose Airport

- Cheap Car Rentals Los Angeles

- Car Rental Long Beach Airport

- Car Rental San Jose Ca

- Cheap Car Rental Los Angeles International Airport

- Cheap Car Hire Los Angeles

- Cheapest Way To Rent A Car In Los Angeles

Electric Bike Rental Guide

Explore Los Angeles on Two Wheels: Discover the City with Convenient Bike Rentals

Saturday, July 29, 2023

Saturday, July 29, 2023

Los Angeles is a sprawling city with a lot to offer visitors. But if you want to see the city at its best, there's no better way than on two wheels. With a bike rental, you can explore the city's many neighborhoods, parks, and beaches at your own pac

- Los Angeles Bike Rentals

- Venice Beach Bike Rental

- Metro Bike Los Angeles

- Electric Bike Rental Los Angeles

- Road Bike Rental Los Angeles

- E Bike Rental Los Angeles

- Mountain Bike Rental Los Angeles

- Bicycle Rental Los Angeles

- Mtb Rentals Los Angeles

- Beach Bike Rentals Los Angeles

- Venice Beach Bicycle Rental

- Electric Bike Los Angeles Rent

- Los Angeles Electric Bike Rental

- Rent Bike La

- Bike Rental Beverly Hills

Catalina Island Bike Rentals: The Best Places to Rent a Bike on the Island

Saturday, July 29, 2023

Saturday, July 29, 2023

Looking for a fun and active way to explore Catalina Island? Rent a bike! There are several great bike rental shops on the island, each with its own unique selection of bikes and amenities. In this article, we'll take a look at the best places

- Catalina Island Bike Rentals

- Catalina Bike Rental

- Browns Bikes Catalina

- Electric Bike Rental Catalina Island

- Catalina Electric Bike Rental

- Catalina E Bike Rentals And Tours

- Electric Bikes Catalina Island

- Electric Bikes On Catalina Island

- Ebikes Catalina Island

- Catalina Island Bicycle Rentals

- Rent Bikes Catalina Island

- Electric Bikes Catalina

Apartments Rental Guide

San Francisco Rights of Tenants and Landlords: A Comprehensive Guide

Saturday, September 16, 2023

Saturday, September 16, 2023

Tenants and landlords in San Francisco have specific rights and responsibilities protected by law. This article provides a detailed overview of San Francisco rent control and eviction protection laws, as well as other important rights for both tenants and landlords.

- Tenants Rights Attorney San Francisco

- San Francisco Tenants Rights Lawyer

- Best Landlord Attorney San Francisco

- Tenant Attorney San Francisco

- Landlord Tenant Attorney San Francisco

- San Francisco Landlord Tenant Lawyer

- Tenant Lawyer San Francisco

- Landlord Tenant Lawyer San Francisco

- Landlord Attorney Sf

- Landlord Attorney San Francisco

- Landlord Lawyer San Francisco

- Eviction Lawyer San Francisco

- Eviction Lawyers San Francisco

- Best Tenant Lawyer San Francisco

- Eviction Attorney San Francisco

Apartments for Rent in Orange County, CA: A Guide to Finding the Perfect Place to Live

Monday, September 11, 2023

Monday, September 11, 2023

Looking for apartments for rent in Orange County? Our comprehensive guide provides valuable insights and a detailed price comparison to help you find the perfect rental within your budget. Explore Orange County's top neighborhoods and discover the ideal apartment for your lifestyle.

- Apartments For Rent Orange County

- Houses For Rent Orange County

- Orange County Apartments

- Orange County Rentals

- Homes For Rent Orange County

- Apartments For Rent Orange Ca

- Apartments In Irvine Ca

- Studio Apartment For Rent Orange County

- Luxury Apartments Orange County

- Studios For Rent Under $700 In Orange County

- Houses For Rent Orange Ca

- Studios For Rent Orange County

- Apartments In Orange Ca

- Apartments In Orange County Ca

- 55 And Over Apartments In Orange County Ca55 Apartments Orange County

Furniture Rentals in San Jose: A Guide to Finding the Best Deals

Saturday, August 5, 2023

Saturday, August 5, 2023

Are you looking for furniture rentals in San Jose? This guide will help you find the best deals on sofas, beds, tables, and more. We'll cover everything from the different types of furniture rental companies to the factors you should consider

- Furniture Rentals San Jose

- Furniture Rental Companies San Jose

- Best Furniture Rental Deals San Jose

- How To Find Furniture Rentals In San Jose

- Table And Chair Rentals San Jose

- Rental Chairs San Jose

- Tables And Chairs For Rent San Jose

- Party Furniture Rental San Jose

- Table And Chair Rentals San Jose Ca

- Party Table Rentals San Jose

- Table Chair Rental San Jose

Furniture Rental San Diego: Find the Perfect Furniture for Your Needs

Saturday, August 5, 2023

Saturday, August 5, 2023

Are you looking for a stylish and affordable way to furnish your home in San Diego? Furniture rental is a great option for those who are short on time, money, or space. There are many different furniture rental companies in San Diego, so you can find

- Furniture Rental San Diego

- Cort Furniture Rental San Diego

- Event Furniture Rental San Diego

- Chiavari Chairs Of San Diego

- Cort Furniture San Diego

- Rent To Own Furniture San Diego

- Lounge Furniture Rental San Diego

- Fashion Furniture San Diego

- Party Furniture Rental San Diego

- Furniture Rental San Diego Ca

- Outdoor Furniture Rental San Diego

- Short Term Furniture Rental San Diego

Short Term Accommodation in San Jose: Most Popular Neighborhoods for Tourists

Monday, July 31, 2023

Monday, July 31, 2023

San Jose is a vibrant city with a lot to offer visitors, from world-class museums and restaurants to stunning natural beauty. There are also a variety of great neighborhoods to choose from, each with its own unique charm.

Furnished Corporate Housing Los Angeles: A Guide to Finding the Perfect Place

Monday, July 31, 2023

Monday, July 31, 2023

Los Angeles is a major business hub, and many companies send their employees to the city for temporary assignments. If you're one of those employees, you'll need a place to stay. Furnished corporate housing is a great option

- Corporate Housing Marina Del Rey

- Furnished Corporate Housing Los Angeles

- Corporate Housing Beverly Hills

- West Hollywood Corporate Housing

- Oakwood Corporate Housing Los Angeles

- Corporate Housing Los Angeles

- Corporate Housing Culver City

- Corporate Housing West Los Angeles

- Corporate Housing Woodland Hills

- Short Term Corporate Housing Los Angeles

- Corporate Housing By Owner Los Angeles

- Corporate Apartments Los Angeles

- Corporate Housing Los Angeles Ca

- Corporate Housing In La

Apartments for Rent in Los Angeles: Your Guide to Finding the Perfect Home

Monday, July 31, 2023

Monday, July 31, 2023

Are you looking for apartments for rent in Los Angeles? This comprehensive guide will help you find the perfect place to live, whether you're a student, a young professional, or a family. We'll cover everything from neighborhoods to amenities

- Apartments For Rent Los Angeles

- Los Angeles Apartments

- La Apartments

- Houses For Rent Los Angeles

- Culver City Apartments

- West Hollywood Apartments

- La Apartments For Rent

- Low Income Apartments Los Angeles

- Downtown La Apartments

- Studio City Apartments

- Westside Rentals Los Angeles

- Luxury Apartments Los Angeles

- Luxury Apartments Los Angeles

- Studio Apartment For Rent Los Angeles

- Apartments For Rent In Downtown Los Angeles Ca

- Corporate Rentals Los Angeles

- Chinatown Apartments La

California Apartment Rentals: A Guide to Finding the Perfect Place to Live

Saturday, July 29, 2023

Saturday, July 29, 2023

California is a beautiful state with a lot to offer renters, but finding a good apartment can be challenging. This guide will help you navigate the California rental market and find the perfect place to call home.

- California Apartment Rental

- California Apartments

- California Rent

- California Rental Market

- How To Find An Apartment In California

- Tips For Renting In California

- Apartments For Rent Los Angeles

- Apartments For Rent San Diego

- Los Angeles Apartments

- San Diego Apartments

- Houses For Rent San Diego

- Apartments For Rent San Jose

- Twentynine Palms Apartments

- Argyle House Los Angeles

- 29 Palms Apartments

- Uptown Apartments Oakland

- Apartments For Rent 29 Palms

Houses Rental Guide

Affordable California House Rental Assistance Programs: Your Guide to Financial Relief

Monday, September 18, 2023

Monday, September 18, 2023

California offers a variety of programs to help residents pay their rent. If you are struggling to afford your rent, you may be eligible for financial assistance. This article provides an overview of California house rental assistance programs, including who is eligible, how to apply, and where to get help.

- Senior Housing San Diego County

- California Rent Relief

- California Rental Assistance

- Rent Help California

- Assistance With Rent In California

- Ca Senior Housing

- Rental Assistance Los Angeles Ca

- California Housing Assistance Programs

- Rent Relief California 2023

- Ca Rent Relief

- Rent Relief California

- Ca Covid 19 Rent Relief

- Covid Rent Relief California

- Rent Relief Ca

- Ca Covid Rent Relief

- California Rent Relief Program

- Ca Rent Relief Program

- California Covid Rent Relief

- Long Beach Rent Relief

Rental Assistance in California: A Guide to Help You Stay in Your Home

Tuesday, August 22, 2023

Tuesday, August 22, 2023

California has a number of programs that offer rental assistance to help low-income households pay their rent. This guide provides information on eligibility requirements, how to apply, and the amount of assistance available.

- Rental Assistance In California

- California Covid Rent Relief

- Need Help Paying Rent In California

- Los Angeles Rent Relief

- California Veterans Housing Assistance Program

- Rental Assistance San Diego Ca

- Help With Rent Contra Costa County

- Emergency Rent Relief California

- Housing Assistance San Diego County

- Financial Assistance For Rent In California

- California Covid 19 Rent Relief Program

- Senior Housing San Diego County

- Programs In California That Help Pay For Rent

- Legal Help For Renters California

Cheap Monthly Rentals in San Diego: Finding Budget-Friendly Options

Wednesday, August 2, 2023

Wednesday, August 2, 2023

Looking for a cheap monthly rental in San Diego? We've got you covered! In this article, we'll list some of the best places to find affordable housing in the city. We'll also provide tips on how to negotiate a lower rent and avoid scams.

Economical and Comfortable: Advantages of Daily Rentals in San Jose

Monday, July 31, 2023

Monday, July 31, 2023

Looking for a comfortable and affordable place to stay in San Jose? Consider a daily rental. There are many advantages to daily rentals, including flexibility, convenience, and value for your money.

Vacation Rental Guide

Vacation Rentals in Los Angeles: The Ultimate Guide

Friday, August 4, 2023

Friday, August 4, 2023

Los Angeles is a city that has something for everyone, and vacation rentals are a great way to experience all that it has to offer. Whether you're looking for a beachfront condo, a Hollywood Hills mansion, or a cozy bungalow in the heart of the city,

- Vacation Rental Los Angeles

- Venice Beach Rentals

- Los Angeles Holiday Rentals

- Holiday Home Los Angeles

- Luxury Short Term Rentals Los Angeles

- Luxury Vacation Rentals Los Angeles

- Beverly Hills Short Term Rentals

- Los Angeles Vrbo

- Redondo Beach Airbnb

- Weekly Rentals Los Angeles

- Cabin Rentals Los Angeles

- Vacation Home Rentals Los Angeles

- Los Angeles Mansions For Rent

- Beach House For Rent Los Angeles

- Venice Beach Vacation Condos

- Vrbo Redondo Beachvrbo Marina Del Rey

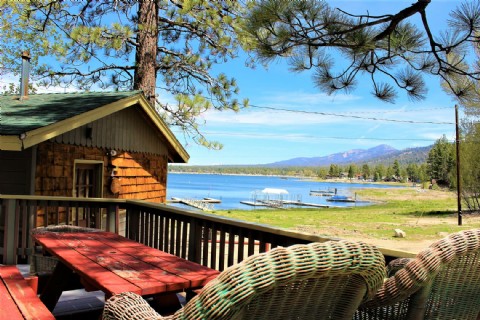

Big Bear City Short Term Rentals: A Guide to Finding the Perfect Place to Stay

Friday, August 4, 2023

Friday, August 4, 2023

Big Bear City is a popular destination for both winter and summer vacations, and there are a variety of short term rentals available to choose from. This guide will help you find the perfect place to stay, whether you're looking for a cozy cabin

The Best Newport Beach Vacation Rentals for Every Type of Traveler

Friday, August 4, 2023

Friday, August 4, 2023

Looking for the perfect vacation rental in Newport Beach? Whether you're traveling solo, with friends or with family, we've got you covered. Here are our top picks for rentals that will suit every need and budget.

- Newport Beach Rentals

- Newport Coast Villas

- Airbnb Newport Beach

- Newport Beach Apartments

- Vrbo Newport Beach

- Newport Beach Vacation Rentals

- Duffy Rental Newport Beach

- Newport Duffy Rental

- Apartments For Rent Newport Beach

- Newport Beach House Rentals

- Newport Beach Houses

- Balboa Island Rentals

- Homes For Rent Newport Beach

- Airbnb Newport Beach Ca

- Villa Rentals Newport Beach

- Vrbo Newport Beach Ca

- Vrbo Balboa Island

- Airbnb Balboa Island

- Corporate Housing Newport Beach Ca

Vacation Rentals in San Diego: The Perfect Way to Explore the City

Wednesday, August 2, 2023

Wednesday, August 2, 2023

San Diego is a city with something for everyone, from its beautiful beaches to its world-famous theme parks. And with so many vacation rentals to choose from, you're sure to find the perfect place to stay for your next trip.

- Vacation Rental San Diego

- Vrbo San Diego

- Airbnb San Diego Ca

- Mission Beach Rentals

- Vrbo San Diego Ca

- San Diego Beach Rentals

- Mission Beach Vacation Rentals

- La Jolla Vacation Rentals

- San Diego Beach House Rentals

- Pacific Beach Rentals

- Vrbo San Diego Beachfront

- Beach House Mission Beach

- Airbnb Pacific Beach

- Pacific Beach Vacation Rentals

- Beachfront Rentals San Diego

- Pacific Beach Pier Cottages

CaliforniaRental.net

CaliforniaRental.net hlpdskcontact@gmail.com

hlpdskcontact@gmail.com Facebook

Facebook Twitter

Twitter LinkedIn

LinkedIn Tumblr

Tumblr